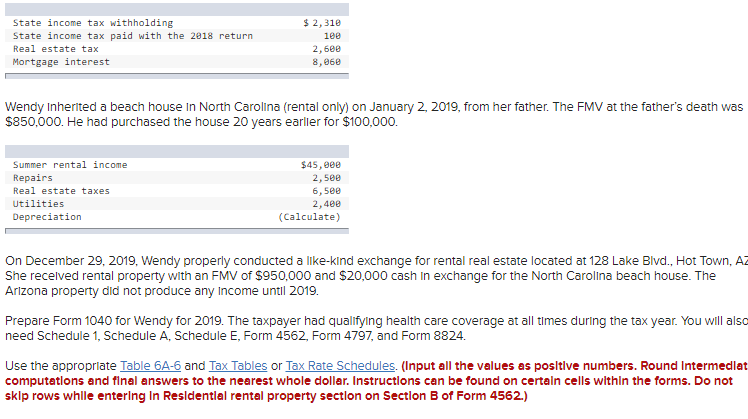

south carolina inheritance tax 2019

This means that if you have 3000000 when you die you will get taxed on the 300000 over the. 2019 the New York estate tax exemption amount will be the same as the.

Property Taxes By County Interactive Map Tax Foundation

Delaware repealed its tax as of January 1 2018.

. Currently South Carolina does not impose an estate tax but other states do. Iowa has a separate inheritance tax on transfers to others than lineal ascendants and descendants. However according to some inheritance laws of South Carolina not all the deceased persons property may be considered.

The federal estate tax is levied on a propertys taxable part before the heir transfers the assets. New for Tax Year 2021 Filing Tips SCDOR offers tax tips for. South Carolina Inheritance Tax Laws.

Tax brackets are adjusted annually for inflation. In January 2013 Congress set the estate tax exemption at 5000000. South Carolina does not tax inheritance gains and eliminated its estate tax in 2005.

This doesnt eliminate other expenses related to estate planning expenses such as inheritance tax that. This doesnt eliminate other expenses related to estate planning expenses such as inheritance. October 16 2019 Janelle Fritts In addition to the federal estate tax of 40 percent some states levy an additional estate or inheritance tax.

South Carolina Inheritance Tax 2019. Seven states have repealed their estate taxes since 2010. It has a progressive scale of up to 40.

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. Twelve states and the District of. South Carolina has no estate tax for decedents dying on or after January 1 2005.

Even though there is no South Carolina estate tax the federal estate tax might still apply to you. Individual income tax rates range from 0 to a top rate of 7 on taxable income. The federal estate tax exemption is 117 million in 2021.

As of 2019 if a person who dies. No estate tax or inheritance tax. Federal Estate Tax.

November 2019 3 october 2019 2 september 2019 3 august 2019 4 july 2019 2 Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. Governor Henry McMaster recently signed a bill allowing for the creation of a statewide filing. No estate tax or inheritance tax.

Minnesota has an estate tax for any assets owned over 2700000 in 2019. No estate tax or inheritance tax. States That Have Repealed Their Estate Taxes.

This tax is portable for married couples meaning that if the right legal steps are taken a married couples estate of up to 234 million is. No estate tax or inheritance tax.

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Free South Carolina Real Estate Property Power Of Attorney Form Pdf Word Rtf

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

General Sales Taxes And Gross Receipts Taxes Urban Institute

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nelson Mullins South Carolina Bill Extends 2019 Tax Sale Redemption Period

South Carolina Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets For 2019

Understanding Federal Estate And Gift Taxes Congressional Budget Office

South Carolina Estate Tax Everything You Need To Know Smartasset

Who Pays Taxes In America In 2019 Itep

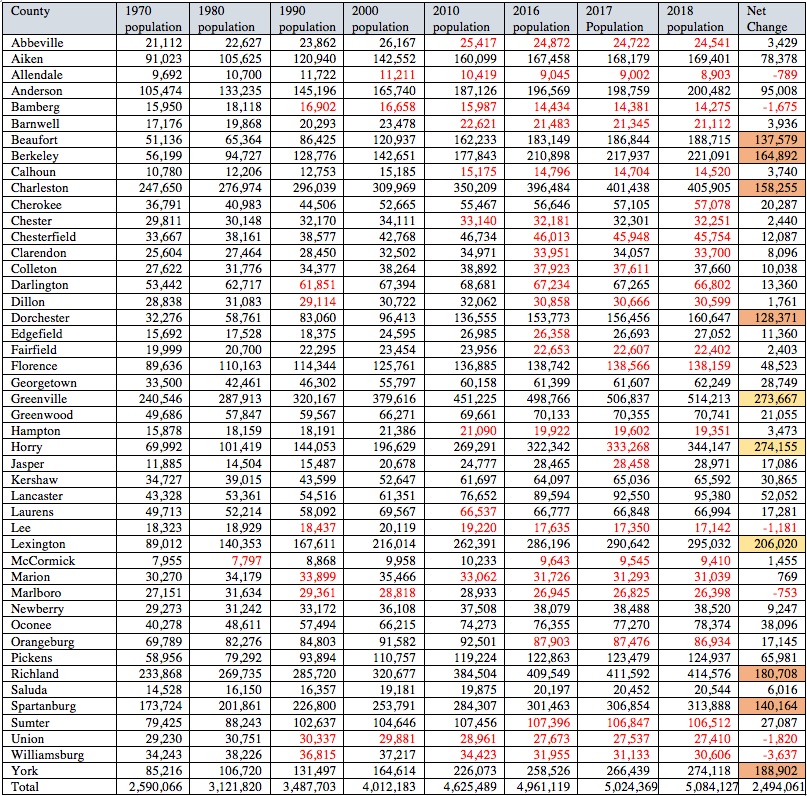

See How South Carolina S Counties Are Growing And Shrinking Gem Mcdowell Law 843 284 1021 Estate Business Law Local